Is your wallet ready for the Autumn Budget 2024? With potential tax hikes and spending cuts on the horizon, here’s what you need to know before the Chancellor takes to the podium.

1. Capital Gains Tax: The Treasury’s Favourite ATM

Expect a hike in Capital Gains Tax rates, possibly bringing them in line with income tax. This could generate an additional £4 billion annually—because why should the wealthy have all the fun of keeping their gains?

2. Inheritance Tax: Death and Taxes, Literally

Rumour has it that inheritance tax might not just be sticking around but could come with a twist—perhaps a “double death tax” where you pay CGT on top of IHT. The overall burden could hit 54%, because why should you rest in peace when the taxman can still cash in?

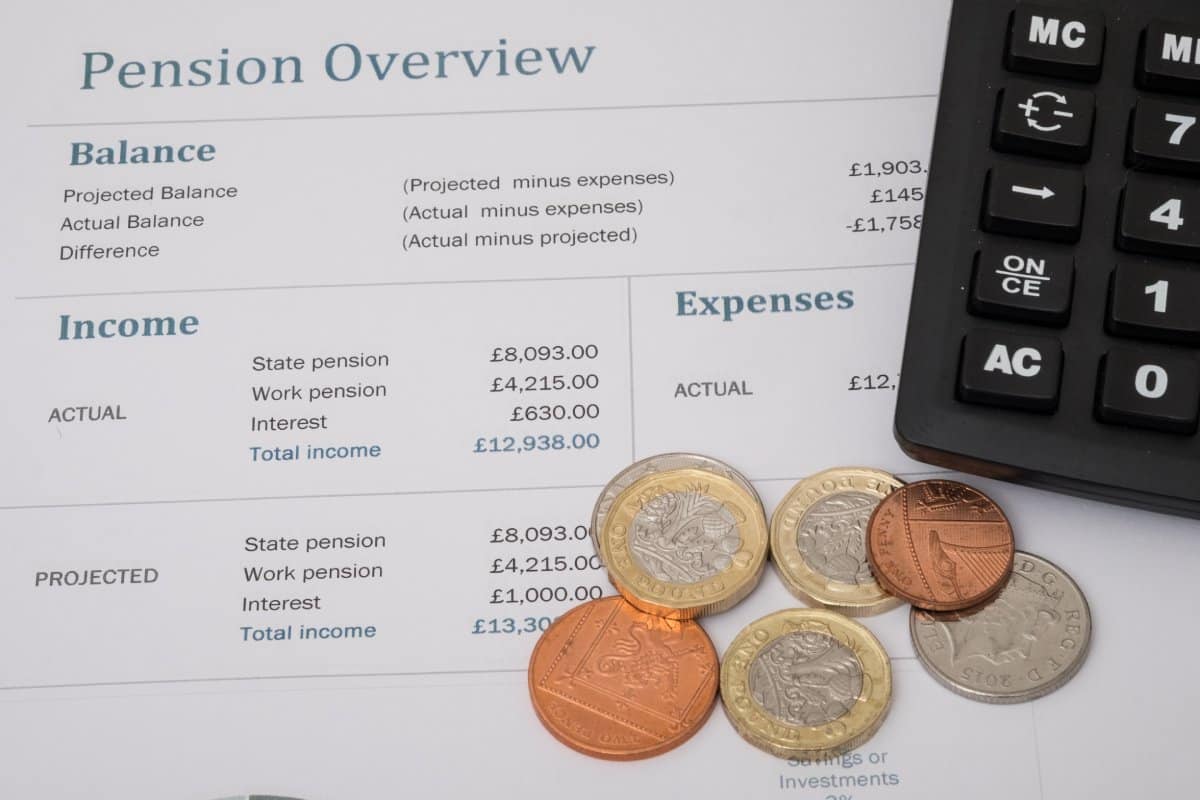

3. Pension Tax Relief: The Middle-Class Dilemma

Labour’s idea of fairness might just involve flattening pension tax relief to a standard 30%. High earners could lose up to 10% of their relief, a move that could add a couple of billion to the Treasury’s coffers while making retirement just that little bit more golden for them.

4. VAT on Private School Fees: Educated in Tax

From January 2025, parents will see an extra 20% added to private school fees as VAT is slapped on, pushing the seven-year cost for a secondary school education up by £28,000. Well, knowledge is power, but it certainly isn’t cheap.

5. State Pension Triple Lock: The Illusion of Generosity

While Labour promises to maintain the State Pension Triple Lock, don’t be fooled—more pensioners might get caught in the tax net as frozen tax bands remain. Inflation-beating increases in your pension? Sure, if you don’t mind handing some of it back in tax.

6. Corporation Tax: Standing Still, for Now

Corporation Tax might stay put for now, but don’t get too comfortable. With a fiscal hole to plug, the government could still spring a surprise increase post-election, despite reassurances to the contrary.

7. Non-dom Rules: The End of the Line?

The axe could finally fall on the non-dom status, with changes to the remittance basis and a crackdown on offshore trusts. The Treasury could claw back billions as the rich lose their tax havens.

8. Holiday Lettings: End of an Era

Come April 2025, the furnished holiday lettings regime is set for the chop. This could cost landlords dearly as they lose out on current tax advantages, potentially raising £1 billion annually for the government.

9. Stamp Duty Land Tax: First-Time Fears

The first-time buyer exemption threshold for Stamp Duty Land Tax might be heading back to £300,000. So, if you thought getting on the property ladder was tough now, just wait until Reeves drops this bombshell.

10. Freedom to Buy: A Nice Idea… In Theory

Labour’s flagship housing policy, Freedom to Buy, might sound great on paper, but with house prices where they are, expect a lukewarm reception as the details (and potential costs) become clearer.

11. Windfall Taxes: Bank On It

The government may well be eyeing up another round of windfall taxes on energy firms, banks, and tech giants. With billions up for grabs, this could be Labour’s answer to balancing the books without touching the sacred “working taxes.”

12. Winter Fuel Payments: A Cold Shoulder

There’s talk that the winter fuel payment could be means-tested or even slashed entirely. With energy prices still sky-high, this could be a bitter pill to swallow for many pensioners.

13. Public Sector Pay: Expect More Strikes

With the purse strings tightening, don’t expect generous public sector pay rises. This could mean more strikes and unrest as workers demand wages that keep pace with inflation.

14. HMRC Crackdown: The Taxman Cometh

HMRC is recruiting 5,000 extra staff to hunt down tax dodgers. The message is clear: if you’ve been playing fast and loose with your taxes, now might be a good time to come clean.

15. Social Care Funding: Promises, Promises

Labour might promise more funding for social care, but with everything else on the table, don’t be surprised if it’s kicked down the road yet again—much to the dismay of an ageing population.

Balancing Promises With Pragmatism

The budget may be called “autumn,” but for many, it’s going to feel like a long, cold winter. Whether you’ll be better off after it remains to be seen, but one thing’s for sure—change is coming

Brace for Impact: The Tax Increase Labour Denied Has Arrived, Reeves Delivers a Grim Outlook

Rachel Reeves delivers the gloomy news, and citizens have to accept the inevitable. The tax increase might complicate finances for some households and businesses. Brace for Impact: The Tax Increase Labour Denied Has Arrived, Reeves Delivers a Grim Outlook

Russia Issues Ultimatum to UK Over Ukraine’s Use of British Arms

Russia has threatened to attack British targets if Ukraine uses UK-supplied weapons amid rising tensions and the recent arrest of a British man charged with spying for Russia. Here’s the full story. Russia Issues Ultimatum to UK Over Ukraine’s Use of British Arms

Tommy Robinson Sparks National Outrage With Far-Right ‘We Want Our Country Back’ Protest in London

Police had their work cut out at a recent protest led by Tommy Robinson in London. Full story. Tommy Robinson Sparks National Outrage With Far-Right ‘We Want Our Country Back’ Protest in London

Featured Image Credit: Shutterstock / Jeanette Teare.

The images used are for illustrative purposes only and may not represent the actual people or places mentioned in the article.