Adverse weather and economic pressures in February impacted UK retail sales, prompting a shift towards ‘insperiences’ and underscoring challenges faced by fashion and household goods retailers amidst mounting uncertainties. Here’s the full story.

Budget Aftermath

The UK is no stranger to bad economic news as the country deals with the aftermath of the Chancellor’s budget.

Hard Hit

However, new figures show how hard the UK retail sector has had it in the past few weeks.

Worst of Both Worlds

February proved challenging for the UK retail sector as inclement weather and the ongoing cost of living crisis converged to dampen sales growth.

Subdued Consumer Sentiment

Despite a marginal uptick in total retail sales, the performance of non-food items experienced a notable decline, reflective of subdued consumer sentiment amidst ongoing concerns over supply chains and inflation.

Unusually Soggy

As many other European countries experienced unusually warm weather in February, Britain saw an unusually soggy month.

Damp and Cold

The damp and the cold compounded existing economic challenges, resulting in a 2.5% slump in sales of non-food items over the preceding three months, according to the latest report from the British Retail Consortium.

Declining Demand

Declining demand was evident across various sectors, including household appliances, furniture, and clothing.

Cautious Approach

The reduced demand for small luxuries reflects the continuing cautious approach of consumers to spending amid a backdrop of considerably weakened economic confidence.

Increased Food Sales

While food sales saw a 6% increase, the growth rate was down compared to previous months, which is another sign that consumers were being more careful with their money.

Considerable Constraint

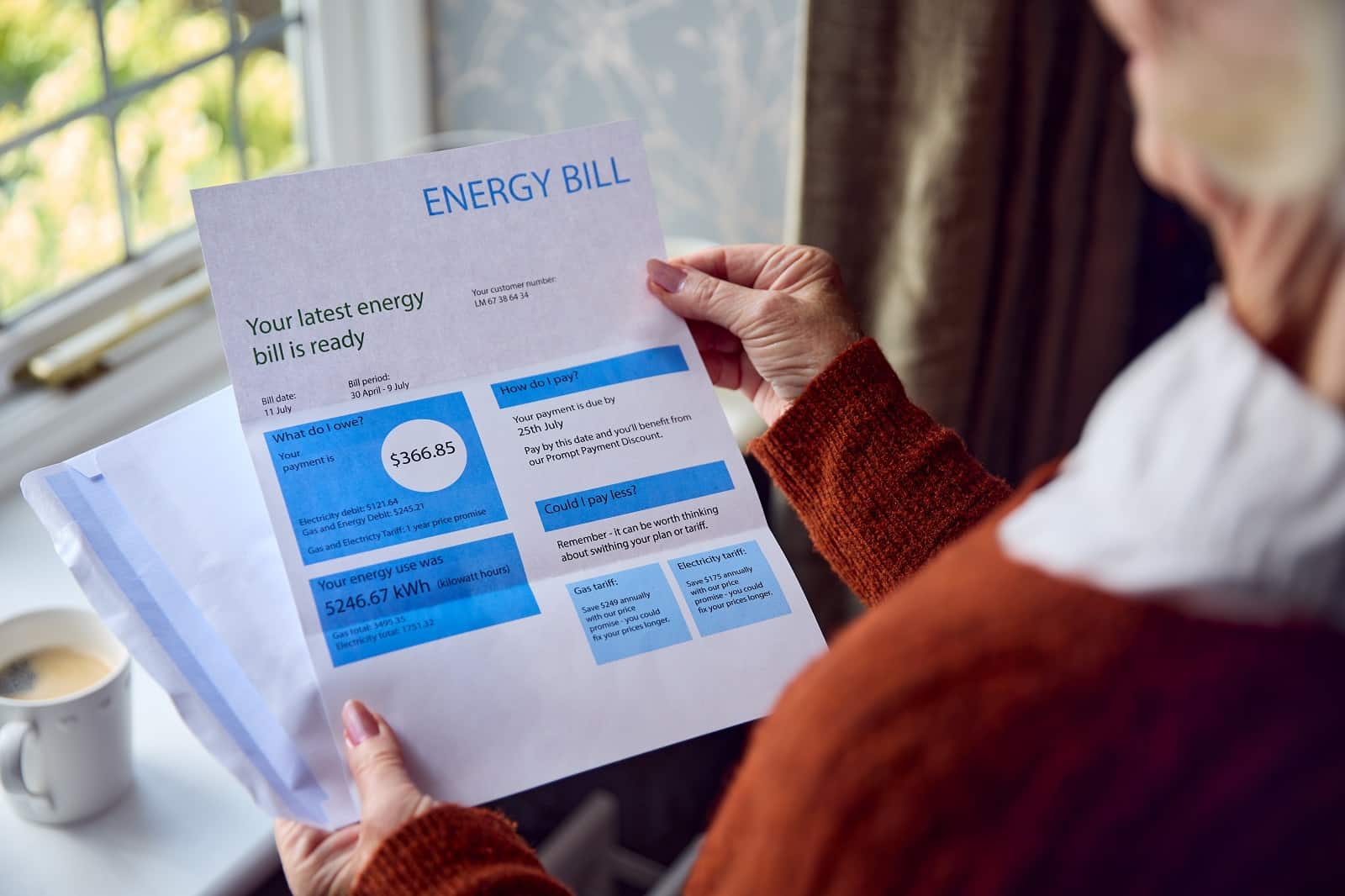

Despite purchases of groceries increasing, consumers exercised considerable constraint as the rising costs of utilities eat into money that would otherwise be spent elsewhere.

No Relief

There was also no relief for those on higher incomes, as interest rates, down from their previous historic heights but still considerably higher than average, make mortgages and other borrowing substantially more expensive.

Noticeable Shift

The unprecedented wet weather in the country during February prompted a noticeable shift in consumer behavior.

Staying Indoors

With outdoor activities limited by the rain, consumers chose instead to stay indoors, leading to increased spending on health and beauty products, toys, and home accessories, as people decided to enjoy the little things in life rather than spending lavishly.

“Insperiences”

Barclays head of retail, Karen Johnson, stated, “February’s wet weather meant Britons chose to spend more time indoors, resulting in a slowdown in high street and hospitality spending. This shift in behavior meant ‘insperiences’ enjoyed a boost, as consumers opted to enjoy cozy nights in with a TV show and a takeaway.”

Streaming Boost

These “insperiences” saw, according to Barclays’ consumer spend report, spending on digital content and subscriptions experience its most significant growth (11.8%) since August 2021.

However, with more people staying in, the hospitality sector bore the brunt of diminished foot traffic, compounded by escalating operational costs.

Hospitality Declines

Declines in spending at restaurants and bars underscored the sector’s vulnerability, with hospitality groups experiencing marginal sales growth amidst mounting challenges.

Rocky Road

Rising energy bills, wage expenses, and food price inflation exacerbated financial strain, prompting concerns about the sector’s resilience if spending patterns remain unchanged.

Lack of Shoppers

Fashion brands and household goods retailers were hit the hardest by the lack of shoppers out on the street.

Physical Shops

Online clothing retailers, in particular, faced challenges as consumers favored physical stores despite adverse weather conditions, citing cost-saving considerations around extra costs, such as delivery.

Failure to Deliver

Helen Dickenson, chief executive of the British Retail Consortium, was particularly glum in her outlook, stating, “Not even Valentine’s Day lifted customers out of the gloom, and gifting products that typically sell well, like jewelry and watches, failed to deliver.”

Stimulate Spending

Government efforts to stimulate consumer spending through cuts in national insurance rates in January failed to translate into tangible retail growth.

Prioritizing Essentials

With households prioritizing essential expenses amidst economic uncertainty, retailers remain cautiously optimistic about the sector’s outlook.

Stimulus Measures

Hopes are pinned on stimulus measures announced in the Chancellor’s spring budget to rejuvenate consumer demand and alleviate financial pressures.

Alarm Bells

As the UK retail sector struggles with adverse weather conditions, reduced online spending, and high-interest rates, alarm bells are ringing for struggling companies like Superdry, Currys, and John Lewis.

Cost of Living Crisis

With consumers prioritizing the little money they have on “insperiences” amidst the cost of living crisis, retailers will continue to face the difficult task of convincing shoppers to part with their cash.

Bleak Outlook

The outlook for shoppers and retailers, just like the weather, remains bleak for the foreseeable future.

More Articles Like This…

Broken Britain: 12 Reasons Behind the UK’s Decline

Say the Unsayable: 10 Occasions When Farage Spoke His Mind About Britain

The post Drowning in Debt: UK Weather Hits Retail Hard first appeared on Edge Media.

Featured Image Credit: Shutterstock / mkfilm.

Grant Gallacher is a seasoned writer with expertise in politics and impactful daily news. His work, deeply rooted in addressing issues that resonate with a wide audience, showcases an unwavering commitment to bringing forth the stories that matter. He is also known for satirical writing and stand up comedy.