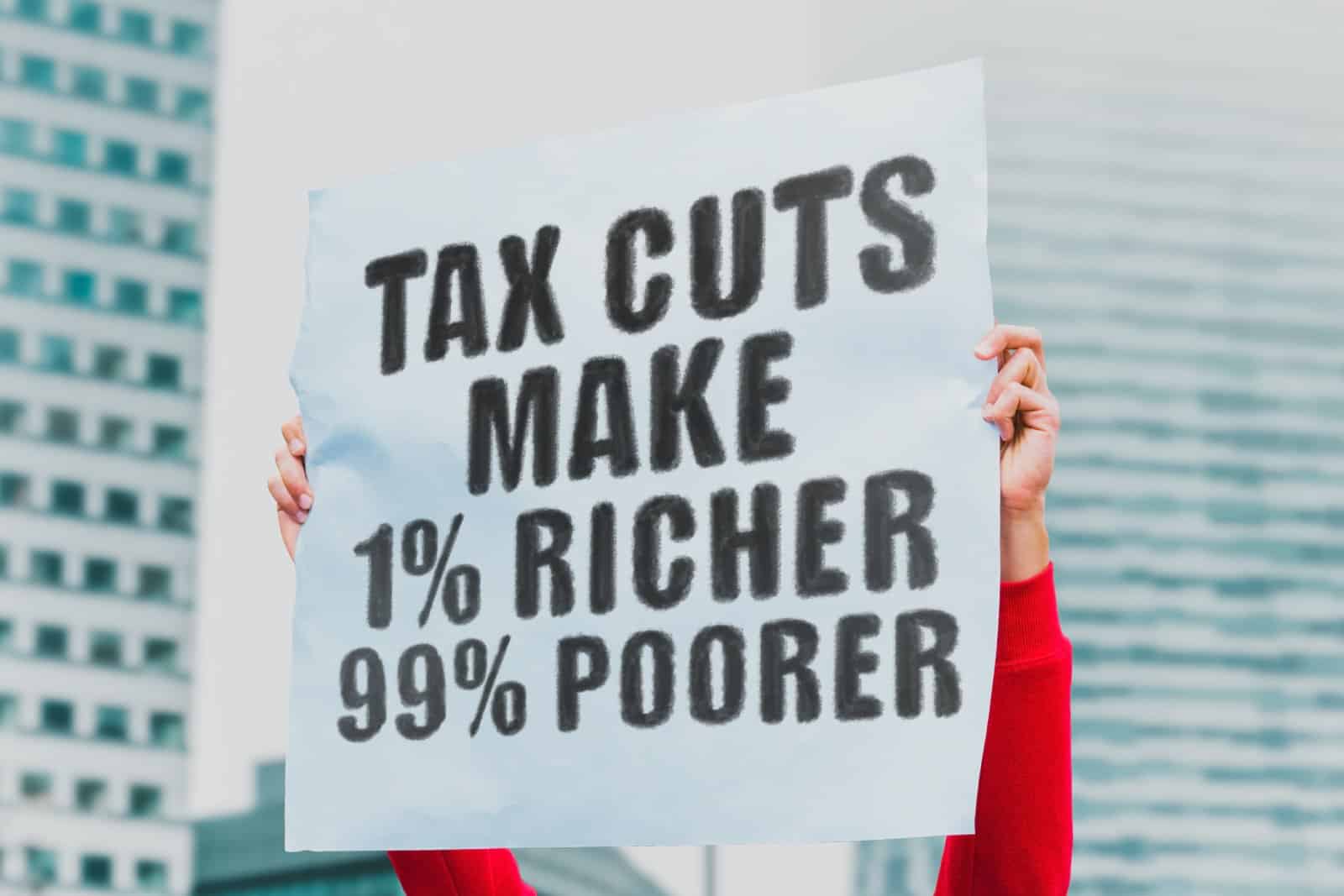

The IMF has warned the UK against further tax cuts, highlighting a potential £30 billion fiscal gap and urging more realistic spending plans to ensure long-term economic stability, but Chancellor Jeremy Hunt seems unswayed. Here’s the full story.

Proposed Tax Cuts

The International Monetary Fund (IMF) has warned the UK government about the many potential risks associated with proposed tax cuts ahead of the upcoming election, which is widely expected to be in the autumn.

£30 Billion Gap

In its latest annual assessment of the UK’s economic health, the IMF highlighted a projected £30 billion gap in the nation’s already strained public finances and advised against any further reductions in National Insurance Contributions (NICs) by Chancellor Jeremy Hunt.

“Difficult Choices”

The IMF’s unusually frank report, which follows a two-week consultation in the UK, emphasised that the government’s spending plans appear unrealistically low and that “difficult choices” lay ahead.

More Realistic Projections

The Washington-based body suggested that more realistic projections would require increased spending to address pressures on public services, particularly health and social care, and critical investments, such as those related to the UK’s transition to green energy.

“Soft Landing”

Despite these concerns, the IMF did acknowledge some positive economic indicators, forecasting 0.7% growth for the UK economy in 2024, up from its previous estimate of 0.5%, which would mean that the UK economy was due for what the IMF called a “soft landing” following its exit from a shallow recession.

Proposed Cuts

Despite some good economic news, the IMF criticised the previous and proposed cuts in NICs, which were widely expected to be Chancellor Jeremy Hunt’s pre-election giveaway.

“Against the Nic Rate Cuts”

The IMF report read, “In light of the medium-term fiscal challenge, staff would have recommended against the NIC rate cuts, given their significant cost.”

“Labour Supply Benefits”

It continued, “But staff does recognise the potential labour supply benefits of the NIC cuts and that they were accompanied by well-conceived measures (e.g. reform of the ‘non-dom’ regime) that will partially offset their fiscal cost over the medium term.”

“Credibly Growth-Enhancing”

The IMF also recommended against additional tax cuts unless they are “credibly growth-enhancing and appropriately offset by high-quality deficit-reducing measures.”

Revenue-Raising Measures

The IMF recommended that the UK government explore a range of revenue-raising measures to stabilise debt by 2029-30, as it projected that government debt as a share of national income could reach 97% of GDP by the end of the decade if spending plans are not adjusted.

£30 Billion

To prevent this, the Fund suggested that the government implement measures equivalent to raising revenue or making savings worth one percentage point of GDP, roughly £30 billion.

“Raising Additonal Revenue”

The report stated, “This could be achieved, for example, by raising additional revenue from higher carbon and road-usage taxation, broadening the VAT and inheritance tax bases, and reforming capital gains and property taxation (which could also allow a reduction in stamp duty), broadly echoing the 2023 Article IV recommendations.”

“Incentivising Work”

It continued, “On the spending side, staff continues to recommend indexing the state pension (only) to cost of living increases, recognising the authorities’ efforts to contain the non-pension welfare bill by incentivising work.”

Further Cuts

The political implications of the IMF’s report are all the more significant as the UK rapidly approaches the next general election. The government’s commitment to further NIC cuts contrasts sharply with the IMF’s cautionary stance, potentially creating a contentious debate over fiscal policy and economic strategy.

Cautious Approach

Kristalina Georgieva, the IMF’s managing director, underscored the importance of a cautious approach to tax cuts, citing the financial strains caused by the COVID-19 pandemic and geopolitical tensions such as Russia’s invasion of Ukraine.

“Genuinely Concerned”

She stated, “We are genuinely concerned, not just for the UK, for all countries that have used fiscal buffers extensively, that they must do more to rebuild these buffers.”

Dual Disagreement

However, both Prime Minister Rishi Sunak and Chancellor Jeremy Hunt disagreed with the IMF’s outlook and recommendations.

“Respectfully Disagree”

A spokesperson for Sunak stated, “I think on that we respectfully disagree with the IMF. My view is that cutting national insurance, rewarding work, is an important part of growing the economy.”

Positive Light

Hunt was similarly reluctant to accept the IMF’s findings and focused on presenting the report positively.

“The UK Economy Has Turned a Corner”

Hunt stated, “Today’s report clearly shows that independent international economists agree that the UK economy has turned a corner and is on course for a soft landing.”

“Upgraded Our Growth for This Year”

He continued, “The IMF have upgraded our growth for this year and forecast we will grow faster than any other large European country over the next six years – so it is time to shake off some of the unjustified pessimism about our prospects.”

Precarious Position

However, despite the Chancellor’s rosy take on the IMF report, the assessment shows that the UK economy is in a precarious position. It seems highly unlikely that the government will change course this close to the election when it needs to curry favour with as many voters as possible to bolster its increasingly precarious vote share.

25 Things You CAN’T Talk About Anymore

Remember the days when you could freely discuss just about anything without fear of sparking controversy? Well, those days are long gone. In today’s hyper-sensitive world, there are topics so fraught with tension that even mentioning them can lead to heated debates and hurt feelings. 25 Things You CAN’T Talk About Anymore

Stranded: 15 Worst British Cars in History

Ever had a car that spent more time with the mechanic than on the road? A car that turned every journey into a game of “Will we actually get there?” If so, you might just see a familiar face (or should we say, chassis) in our countdown to the most unreliable British car in history. Stranded: 15 Worst British Cars in History

“Britain Will Become Unrecognizable” – Suella Braverman Spells Disaster for UK Amid Steep Rise in Visas Issued

Former Home Secretary Suella Braverman has warned that Britain will become “unrecognizable,” criticizing the amount of work visas the Home Office has approved, despite only being removed from her role in November. “Britain Will Become Unrecognizable” – Suella Braverman Spells Disaster for UK Amid Steep Rise in Visas Issued

20 Things From the ‘70s That Are Not OK Today

Step into the time machine and set the dial to the 1970s, a decade of disco, bell-bottoms, and some rather questionable choices. While the ’70s gave us iconic music and groundbreaking TV, not everything from this groovy era would get a green light today. 20 Things From the ‘70s That Are Not OK Today

20 Best and Worst Universities in the UK

Navigating the UK university landscape is like deciphering a complex code of rankings, reviews, and reputations to uncover where you’ll not just learn, but truly flourish. Whether you’re drawn to the historic halls of Oxford or the creative buzz of Goldsmiths, finding your perfect fit is about aligning your aspirations with the unique offerings of each institution. 20 Best and Worst Universities in the UK

The post IMF’s Stark Warning on UK Fiscal Outlook, Chancellor Remains Undeterred first appeared on Edge Media.

Featured Image Credit: Shutterstock / Alexandros Michailidis.

Grant Gallacher is a seasoned writer with expertise in politics and impactful daily news. His work, deeply rooted in addressing issues that resonate with a wide audience, showcases an unwavering commitment to bringing forth the stories that matter. He is also known for satirical writing and stand up comedy.