Jeremy Hunt’s pre-election budget has analysts dissecting the implications of tax cuts nestled within a ‘tax sandwich’ of increases, as he attempts to balance immediate relief and future fiscal responsibility. Here’s the full story.

Lighten The Load

Following the avalanche of bad economic news over the last few weeks, Rishi Sunak’s government is looking for anything they can give the public to lighten the financial load.

Much Anticipated Budget

Chancellor Jeremy Hunt’s much anticipated Budget is a chance for the embattled government to help citizens struggling with the ongoing cost of living crisis.

Rose Tinted Glasses

However, the news might not be as rosy as everyone might have hoped, with Hunt’s fiscal manoeuvring drawing the attention of analysts and sceptics alike.

Delicate Balance

Hunt seems to be attempting to balance the already enacted tax increases and planned future rises.

“Tax Sandwich”

The Resolution Foundation has described Hunt’s plans as a “tax sandwich,” characterized by significant tax rises which have already been put in place, followed by anticipated cuts before the elections, with future tax rises to follow a Conservative victory.

Unclear Finances

The latest figures for the public finances are unclear, with different projections suggesting varying degrees of fiscal flexibility for the chancellor.

Ideological Analysis

Differing think tanks have produced different analyses that tend to lean more towards their ideological underpinnings than strict reality.

£23 Billion

The Resolution Foundation, an independent think tank, anticipates a potential £23 billion surplus due to lower interest rates.

£15 Billion

However, the financial services think tank Capital Economics estimates a more conservative surplus of £15 billion.

Tax Cuts

Regardless of the numbers reached, both foresee a portion allocated for tax cuts in the upcoming Budget.

Red Meat

Hunt is undoubtedly attempting to throw some red meat to the tax-averse conservative base.

March Budget

James Smith, Research Director at the Resolution Foundation, was at pains to stress this point, “The chancellor may see some small improvements to the outlook for the public finances ahead of his March budget. He and the prime minister have made it clear they’ll spend any improvement on pre-election tax cuts.”

Lessons From History

However, Smith also cautioned, stating, “History also tells us those future tax rises will be even bigger, as governments tend to hike taxes early in a new parliament. Implausibly large cuts to public services that are pencilled in for after the election mean history may well be about to repeat itself.”

Several Options

Several options are on the table, including a freeze to fuel duty, adjusting income tax rates, or revising benefit thresholds.

Difficult Decisions

Despite these options, Hunt still faces difficult decisions on where to allocate resources, with whatever choice he makes having implications for public support and the health of the economy.

Specter of Tax Increases

Despite the much-anticipated relief that follows proposed tax reductions, the spectre of tax increases in the future hangs over any discussions of the Budget like a shroud.

Stamp Duty and Income Tax

Tax increases slated for introduction post-election include elevated stamp duty rates and an additional three years of income tax threshold stagnation.

“Fiscal Fiction”

The government’s contention that day-to-day spending on public services would rise by only 1% was described by the Resolution Foundation as a “fiscal fiction.”

Spending Cuts

Such a slight rise in spending would necessitate cuts in other areas of public spending, though health, education, and defence budgets have been ring-fenced.

Public Services Collapsing

At a time when many public services are on the brink of collapse, any additional cuts will be a hard sell for the government to make to the public.

Bankrupt Local Governments

The Resolution Foundation has suggested that departments like the Home Office and local governments, several of which have recently declared bankruptcy, would likely bear the brunt of potential spending cuts.

£30 Billion Extra

According to the Resolution Foundations calculations, the government would need to come up with £30 billion extra to spend to avoid cuts to those departments.

Economic Toll

The need for increased spending is becoming evident in light of the dire state of public services, the economic toll on families up and down the country, and the expected budgetary tax cuts.

Safeguarding Public Services

The need to safeguard vital public services and mitigate the impact of austerity measures will require a substantial increase in public spending.

Promising Much, Delivering Little

The government’s current attitude is one of promising much and delivering little, holding tax cuts as paramount to the economic malaise the country finds itself in.

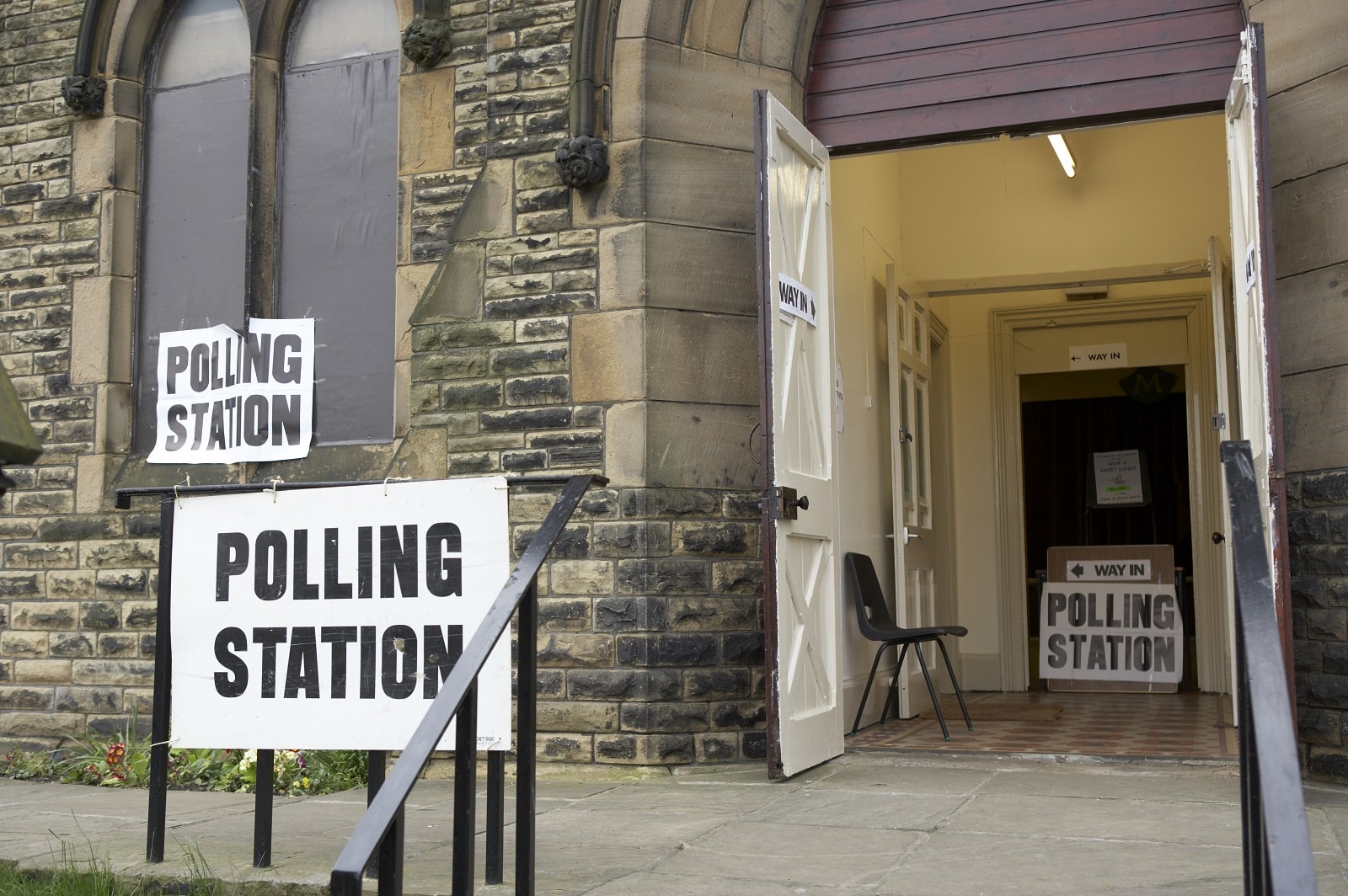

Election Giveaway

As the budget announcement approaches, citizens await the unveiling of policies that will shape the country’s economic trajectory for the foreseeable future, at least until the upcoming election.

The Upcoming Election

Following the election, the finances of the country, the tax burden on citizens, and the health of vital public services will depend entirely on which government is elected.

More Articles Like This…

Broken Britain: 12 Reasons Behind the UK’s Decline

Say the Unsayable: 10 Occasions When Farage Spoke His Mind About Britain

The post Budget Balancing Act: Hunt’s ‘Tax Sandwich Strategy’ Before the Ballot May Leave a Bad Taste for Many first appeared on Edge Media.

Featured Image Credit: Shutterstock / Sean Aidan Calderbank.

Grant Gallacher is a seasoned writer with expertise in politics and impactful daily news. His work, deeply rooted in addressing issues that resonate with a wide audience, showcases an unwavering commitment to bringing forth the stories that matter. He is also known for satirical writing and stand up comedy.